My cheap full coverage car insurance blog 8556

AboutThe Ultimate Guide To The Complete Guide To Car Insurance For Teens - Your Aaa ...

Another common discount rate used by numerous insurer is an "Away At School" discount. This discount might apply if your 18-year-old is going to college at least 100 miles away from house and leaving their car behind. If they take their vehicle with them to school, the discount does not apply.

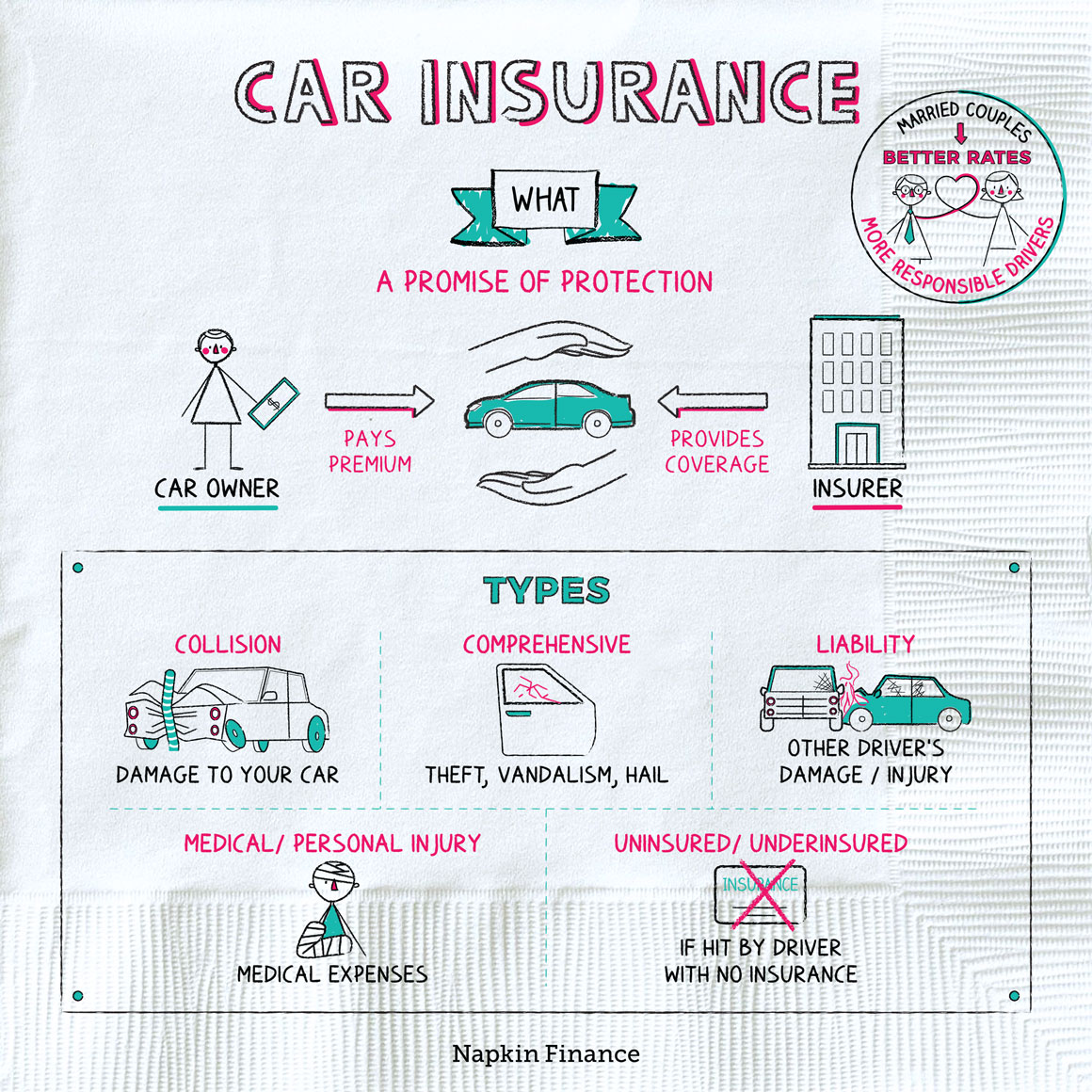

If you purchase a brand-new automobile with a loan, the lending institution might require that you bring comprehensive and accident coverage. In contrast, a car that costs a number of thousand dollars to replace in http://carinsurancecalculatorklls708.iamarrows.com/what-does-cheap-car-insurance-affordable-auto-insurance-company-do case of an accident may require to bring full coverage even if you aren't dealing with a loan provider.

Choose a Sedan Over a Sports Car, Selecting the best car for your teenager can save you numerous dollars each year. A sports car or high-end car might be enjoyable to drive, however these vehicles will substantially increase insurance expenses for a new motorist. A safe, basic sedan is often the cheapest vehicle to guarantee for a teenager.

See This Report about How Much Is Car Insurance? - Policygenius

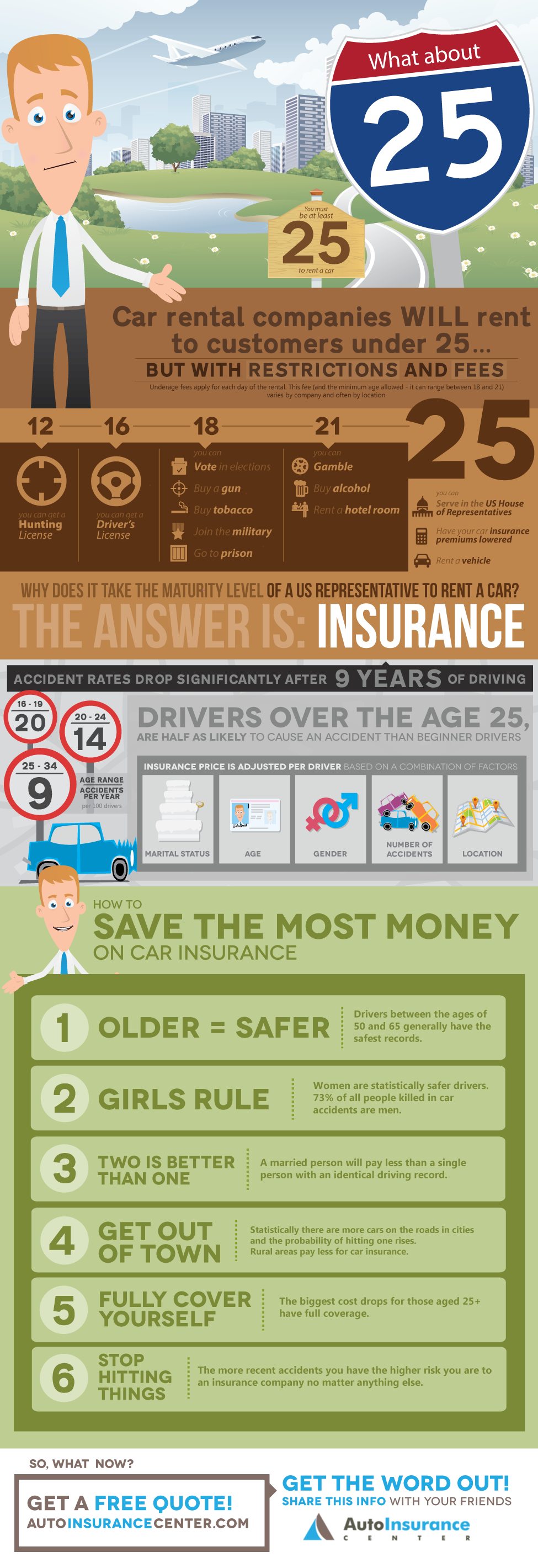

Why Is Automobile Insurance So Costly for an 18-Year-Old? Cars and truck insurance for 18-year-old motorists is pricey due to the fact that insurance business utilize your driving history to determine your insurance coverage rates.

Insurance providers likewise do a reasonable amount of research study into statistical groups, with years of records showing that teen motorists are more most likely to be reckless behind the wheel than chauffeurs in other age groups. Traffic Statistics for 18-Year-Old Drivers, Ranking chauffeurs on these factors might appear tenuous, but the variety of deadly crashes, injuries and other accidents don't lie.

75 fatal crashes for every single 100 million miles driven. The numbers reveal that 18- and 19-year-old drivers were just associated with 2. 47 deadly crashes, while 20- and 21-year-old chauffeurs were associated with 2. 15 deadly crashes. Driving does get more secure as you age and have more driving experience.

The Definitive Guide for What's The Best Car Insurance For Teens? - Metromile

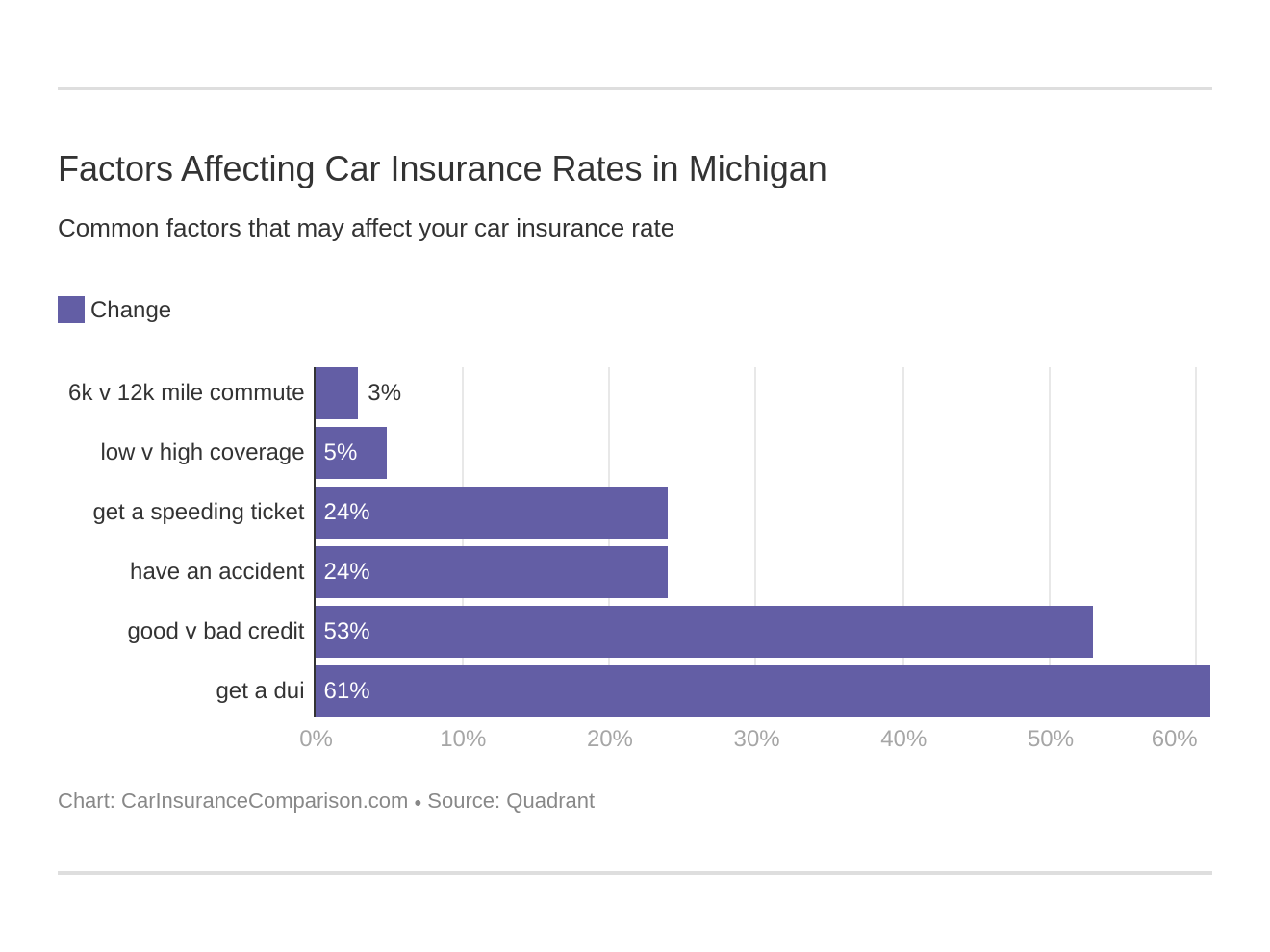

This means that the exact same person could see a considerable difference in their insurance coverage rates by moving from one state to another. Teenagers in Michigan, Louisiana and New York will have some of the highest insurance rates in the country.

Sometimes this is since the legislature does not enable insurance coverage companies to rate customers based upon age. Other times, it is due to the fact that the population of an area is much lower, lowering the probability that a driver of any age will be in an accident. Hawaii and Iowa are the states with the most affordable rates for 18-year-old drivers.

Because insurance coverage rates are based upon a variety of individual elements, your rates may be higher or lower than those noted in this short article. You can see the information used to determine these averages on our approach and disclaimer page. Read More on Automobile Insurance Coverage, Car Insurance Coverage, Automobile Insurance, About the Author.

5 Easy Facts About Add Teen Car Insurance To Your Policy - State Farm Explained

There comes a time in most young chauffeurs' lives when they need to ask themselves an essential question: Should I get my own vehicle insurance plan or add myself to the one my parents already have? A new research study suggests the latter choice is the method to go. A recent Quadrant Info Services study, commissioned by, analyzed the economic effect of a young driver getting his or her own insurance plan versus being contributed to a parent's existing policy.

According to the study, U.S. chauffeurs between the ages of 18 and 24 pay, typically, eight percent more for their own individual insurance coverage than they do when included to an adult's. In some states-- and for particular types of chauffeurs-- the boost can be more than 50 percent." The bottom line is that young drivers are more costly to insure, and if they want their own specific policy, it's going to come at an expense," states Mike Barry, spokesperson for the not-for-profit Insurance Information Institute.

" Parents will typically have numerous policies with the exact same insurer, so our sense is that the insurers ... will try to keep a lid on premiums when it pertains to including their kids." To be sure, the expense of a private policy differs depending on the motorist's age. According to the study, 18-year-old drivers will pay, usually, 18 percent more for a specific policy than they would if contributed to their parents' policy.

The Of What Is The Cheapest Auto Insurance Rate For An 18-year-old ...

Drivers in between the ages of 18 and 24 in Rhode Island will pay, on average, 19 percent more for their own policy than they would if included to a moms and dad's existing policy. Meanwhile, motorists of the exact same age in Arkansas and Mississippi will pay just 5 percent more for their own policy than they would if contributed to an existing policy.

Illinois-- No distinction. 4. Mississippi-- 5 percent. 5. South Carolina-- 5 percent. The image becomes even more complex when breaking down the outcomes by age. An 18-year-old motorist in Rhode Island will pay an average of 53 percent more for a specific policy than he or she would if added to an existing policy.

An 18-year-old motorist in states such as Illinois, Alaska and Florida pays simply seven percent more for a private policy compared to being added to an existing one. And in Arizona, Hawaii and Illinois, it in fact becomes cheaper, usually, for a young motorist to get his/her own policy after turning 19.

Facts About Cheap Car Insurance For An 18 Year Old - Reddit Revealed

The typical cost of car insurance coverage in the U.S. is around $1,652 per year (or about $137 each month), based on rates for 30-45-year-old drivers, according to a 2021 analysis of cars and truck insurance rates by Policygenius. Car insurance rates are various for every chauffeur, which makes it tough to forecast what you'll pay for coverage.

The cheapest states for automobile insurance coverage normally have lower minimum protection requirements, indicating you can conserve by choosing out of particular types of protection. Idaho, for instance, doesn't mandate injury defense (PIP), which is required in no-fault states and covers your injuries after a mishap, or uninsured/underinsured vehicle driver protection, which covers damage caused by a chauffeur without insurance coverage.

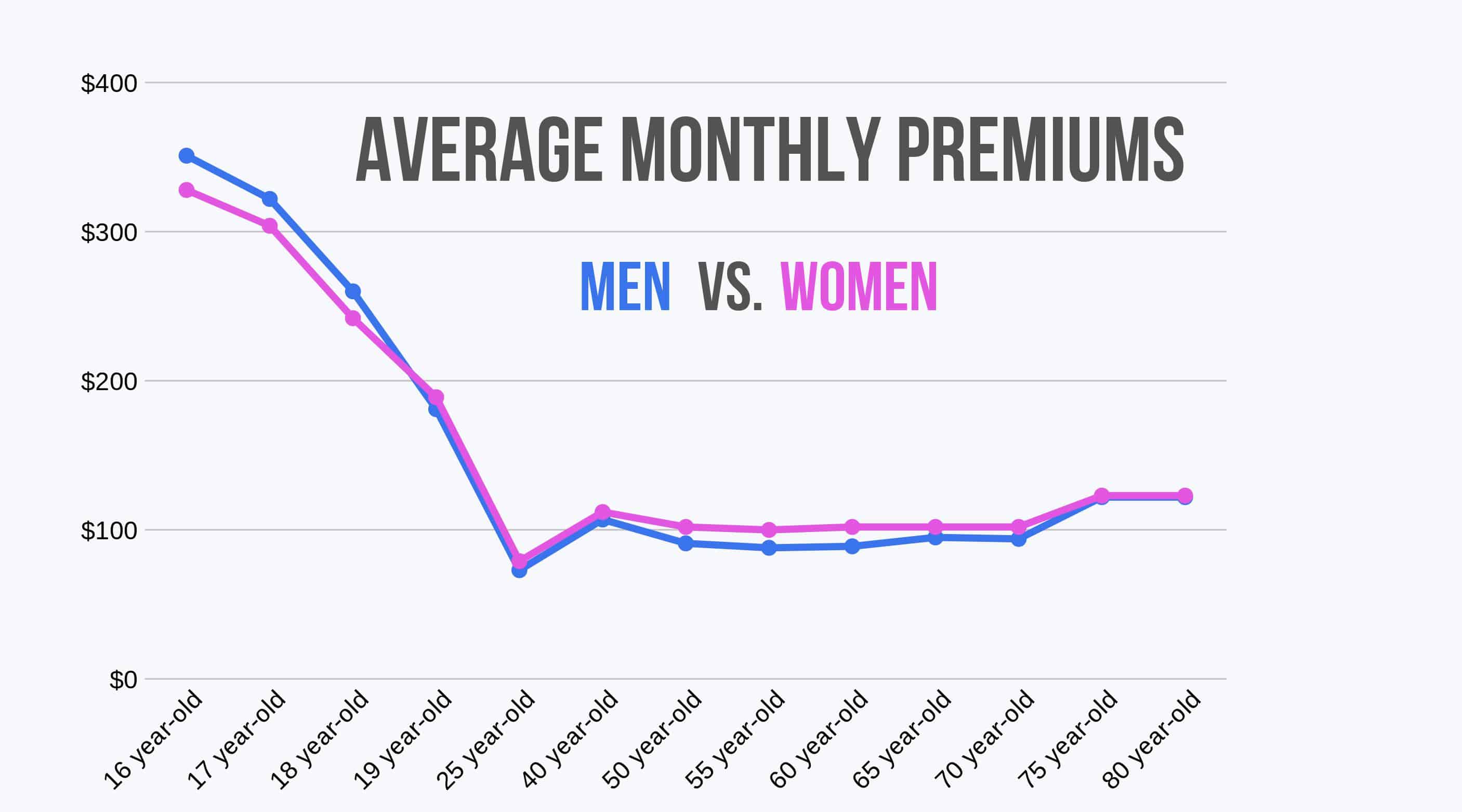

Younger, less skilled motorists pay more since they're more most likely to have a mishap and sue. Your gender can likewise have an impact on your rates, although some states do not permit car insurer to utilize gender as an aspect when computing how much to charge for coverage.

Cheapest Car Insurance For An 18-year-old for Beginners

https://www.youtube.com/embed/PTs6UY1G9wMYou should still have reasonably high liability limitations, even if your vehicle is a clunker, since you might quickly cause thousands of dollars worth of damage in a mishap. However if your vehicle deserves less than a typical thorough or accident deductible and you would be fine paying of pocket to change it if it were taken, you can restrict your protection to liability-only, and conserve by not spending for comp and collision.

AboutIndicators on Auto Insurance For Teen Drivers - Lower Premiums You Need To Know

Charges can land you back in the traveler seat. Death and injury are the highest rate chauffeurs can pay for drinking and driving, however even if you manage to make it through, a D.U.I. ticket will cost teens big time. As a teen driver, you'll likely be cancelled and if you can get insurance, expect to pay a much greater rate for the next 3-5 years.

Rack up more than three and teens face cancellation or non-renewal. Drive an "insurance coverage friendly" car. Cars and trucks that are a favorite target for thieves, are pricey to repair, or are considered "high efficiency" have much greater insurance expenses. Before you buy a cars and truck, call your insurer to get a quote on what it will cost to insure.

Should Your Teenager Have Their Own Car Insurance Policy? - An Overview

Some insurance provider such as SAFECO deal innovation to help parents track teen chauffeur behavior such as global positioning systems (GPS) which record where a cars and truck is driven and how fast. American Family partners with a company that installs in-vehicle cams to monitor driver behavior. Commonly Asked Concerns About Car Insurance A.

In numerous states, you must be 18 before you can own an automobile without an adult's name on the auto registration. A. Car insurance coverage policies usually last 6 months. You will receive a notification when it's time to restore your insurance.

The Facts About Teenage Car Insurance: Everything You Need To Know - Jerry Revealed

A. Under a lot of situations, someone using your vehicle with your permission is covered by your insurance. If the person borrows your automobile with your permission and is associated with a mishap, your insurance coverage will pay just as if you were the motorist. In some states, some insurers might restrict the protection.

.jpg)

In this example, a young chauffeur could see the price of their insurance coverage more than double after one ticket and one accident. Simply to highlight, the business used much better than typical protection for our rate examples, not barebones protection, so they are not the business's lowest rates. All are based upon the teenager driving a 2003 Honda, normal use.

Our 10 Top Car Insurance Companies For Young Adults In 2021 Diaries

If you have an older car with low market price, it might be an excellent idea to reduce your premium by getting rid of accident coverage. When you lend your vehicle to someone and they cause an accident, it is their automobile insurance coverage that will cover the damages on your cars and truck.

Discount rates aren't the only way to save money on your teenager's cars and truck insurance coverage. Here are some other tips to assist decrease your bill. Buy an older automobile The expense of an automobile assists identify the cost of your insurance, so get your teenager an older, less expensive automobile. Older cars that are paid completely provide you the option to drop accident and thorough insurance coverage and carry just liability defense.

The 10-Second Trick For The Best Car Insurance For Teens For 2021 - Verywell Family

It likewise comes from your auto insurance premium increase when you add a teen chauffeur to your policy. Find out about including a teen chauffeur to your policy and some companies that offer discount rates on car insurance coverage.

Some car insurance offers some safe driving discount rates to teenagers who finish a teen driving course. You may even find companies that use both driving courses and good grades as discount rates.

See This Report about How To Save Money On Car Insurance For Teens - The General

Check with your insurance coverage representative to discover out if there are other methods you can utilize to minimize your insurance premiums. You may be able to discover better prices with another business for your entire household.

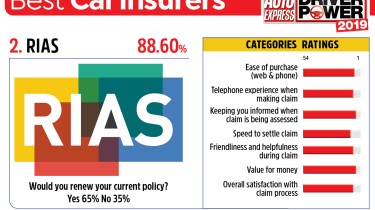

You have to think about the coverage you are getting, the cost you pay for it, and the insurer's track record. Business That Deal Teenager Safe Driving Discounts Here are a few of the various safe driving programs and discount rates from leading car insurers. AAA Insurance AAA Insurance coverage has a teen safe chauffeur bundle that might save you some cash.

The Greatest Guide To Teenage Car Insurance: Everything You Need To Know - Jerry

It keeps an eye on tough braking, velocity, night driving, and distance. If it's in the car your teenager drives and they drive safely, you could see a discount rate of up to 40%.

Bundling your insurance with one provider is an excellent method to lower your insurance expenses, even with a teen chauffeur. Allstate also supplies access to teenager, SMART. When chauffeurs under the age of 25 total the course, you'll get a discount for them. State Farm State Farm has several options that can help in reducing the bill after adding a teen chauffeur.

The 8-Minute Rule for Guide To Car Insurance For Teens

In its "Guide Clear" program, State Farm has 5 training modules. Your teenager is then asked to drive at least 10 trips with a coach that amounts to 5 hours of driving time.

Once the program is total, your teenager gets a certificate that you can send to your representative for a discount rate. State Farm also says you may be able to lower your insurance bill by making certain the cars and truck your teen drives has the latest safety choices and is a less costly model.

Nine Ways To Reduce Your Teen Driver Auto Insurance Costs Can Be Fun For Everyone

For parents, the excitement of having a novice driver in the home is typically tempered with concern. With little driving experience, immature motorists are at a greater risk for accidents. Of course, security concern is uppermost in a lot of parents' minds however other stressorslike the high expense of guaranteeing your new motorist and the monetary liability implications of a teenager driving mishapcan be reduced with these actions.

https://www.youtube.com/embed/Um1_tf_FO3s

Encourage favorable habits Car insurers provide discount rates or reduced premiums to: Trainees who preserve at least a "B" average in school Teens who take a recognized chauffeur training course University student who attend school a minimum of 100 miles far from home and do not bring their vehicle to school Choose the ideal auto insurance company It's generally more economical for parents to add teenagers to their car insurance plan than it is for teens to buy one on their own.

AboutExcitement About Brochure: Lowering Your Auto Insurance Costs - Kraft ...

1. Shop around, Automobile insurance rates differ by hundreds of dollars a year among insurers for the exact same levels of protection, so it is necessary to check rates. An excellent chauffeur with good credit can conserve more than $100 a month, usually, by discovering the cheapest insurer rather of the most expensive in the state, a Nerd, Wallet analysis discovered.

Those motorists may decrease their car insurance coverage costs by more than $200 a month, typically, by picking the least expensive insurance provider rather of the costliest. Typically, rates from a state's most affordable commonly offered insurance company are less than half the rates from the most expensive one, according to our analysis, which compared sample rates for 40-year-old drivers purchasing a full-coverage policy.

Top Guidelines Of How To Decrease Your Auto Insurance Costs - Improv Traffic ...

And the least expensive company for an excellent motorist with excellent credit may not be most inexpensive for somebody with poor credit or a recent mishap. To make sure you're getting the best rates for you, get quotes from numerous business once a year.

Benefit from car insurance discounts, Every insurance business provides special methods to reduce your car insurance coverage premium. To make sure you're getting all the discount rates you're entitled to, ask your representative to examine your possible cost savings. Here are some discount rates provided by the four largest vehicle insurance companies. Remember to compare quotes based on your own situation.

Everything about 8 Ways To Lower Your Auto Insurance Premium - Money ...

/GettyImages-1004420614-d368080d9b9742c2a9b97753639288ec.jpg)

Some insurance business, like Direct Car, objective to make regular monthly vehicle insurance coverage payments more inexpensive. Comparison store with each insurance coverage business to see if you could get inexpensive car insurance! There's no one reliable approach of decreasing your cars and truck insurance bill due to the fact that your particular coverage, your driving history, location, type of automobile, and a host of other variables all play parts in the final last toll.

The typical American invests simply 2. 4% of their yearly earnings on car insurance coverage, however at about $140 monthly, it makes good sense why most motorists seek to conserve where they can. Whether you reside in an area with the most affordable average car insurance rates or one where car insurance coverage tops the national average, there are numerous ways to decrease this necessary cost.

Not known Factual Statements About 15 Tips And Ideas For Cutting Car Insurance Costs

As complex as automobile insurance coverage can be, there are numerous simple methods to reduce the cost and give yourself more space in your budget. Bankrate's insurance editorial team has actually developed a list of methods to assist minimize your vehicle insurance cost.

You might conserve by guaranteeing multiple policy types under the same business. Bundling your house and automobile insurance normally offers the most substantial cost savings. You might conserve by having a clean driving record. In addition to your driving record, if you keep safe driving practices, you may earn an extra discount.

About How To Lower Your Car Insurance Rates

You could save if you become part of a specific profession, like an instructor. More youthful motorists can be more pricey to guarantee, but great student discounts might help to minimize that expense. For instance, insurance providers will normally use a student discount rate to those who keep a minimum of a B average in school.

To do so, a lot of individuals decide to acquire both crash and extensive protection likewise understood as complete coverage when purchasing car insurance coverage. Nevertheless, those with older cars might discover that this is not always the most helpful option. However, since insurance companies typically pay out as much as the real money value of your lorry, buying extensive and accident protection for a highly depreciated or older vehicle might be counterintuitive.

The 15-Second Trick For Tips On Lowering Premiums - Missouri Department Of Insurance

The greater out-of-pocket expense will naturally lower your premium. Just be sure that you can manage the deductible if you have an accident before selecting a higher amount.

You might discover that one insurer uses much better rates when roadside help is included, which could be an extra $20 per year. With several additional coverages, the distinction in between companies is likely to be much more significant, so precise contrasts are important. If you have a tight budget plan, you might decide it is worth evaluating which coverages are essential to you.

The smart Trick of How To Lower Car Insurance Premiums - Jerry That Nobody is Talking About

By examining your desired coverages before requesting for quotes, you might be able to determine some areas where a standard policy suffices. Numerous insurance companies now provide tools on their websites where you can compare insurance quotes. Some companies compare quotes with significant competitors side-by-side. You might still want to verify these quotes separately.

Lots of larger insurers are household names, smaller companies may provide lower rates and tailor protection to fit regional needs. It might also deserve checking out the business's customer complete satisfaction and financial strength. With both of these factors comprising a large part of the insurance experience, you may discover that selecting a solvent company ultimately saves you more cash by making sure a prompt claim payment.

The Buzz on Shoppers' Guide - How To Lower Your Car Insurance Rates

Power and AM Best, could be great locations to begin your research. To find an affordable automobile insurance coverage company and lower your vehicle insurance expenses, you could benefit by taking your driving history and habits into factor to consider. Each service provider is various, and some concentrate on using insurance coverage for specific groups of vehicle drivers.

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg)

If you fall into a high-risk category, there are still affordable vehicle insurance coverage business available.

Indicators on How To Lower Car Insurance Rates: Uncommon Discounts You Should Know

Choosing a different plan is a terrific way to lower your costs, however bear in mind that decreasing your protection or changing to a high deductible plan can also increase your danger. If you take this approach, understand that you may have to pay more expense if you make a claim.

Each cars and truck insurance company utilizes somewhat various rates models so the very best supplier for you will depend on how well-matched you are to the insurance coverage supplier. For instance, one business could have much better rates for brand-new chauffeurs while another business might be better for a high-mileage chauffeur. You can improve rates by bundling together multiple kinds of insurance.

Things about Get The Best Car Insurance Rate - Nationwide

When you get your insurance quotes, insurance service providers might consider your credit rating if it's legal to do so in your state. This can mean that enhancing your credit report will help you to lower your base rates. The primary step to improving your credit history is to examine your credit report.

Take steps to slowly enhance your credit score through monetary practices such as paying your costs on time. Some providers use discount programs based upon your actual driving practices depending on the state where you live. These programs generally use a telematics device set up in your car to track driving behaviors such as tough brakes, the quantity of driving, and the time of day.

Some Known Incorrect Statements About How To Lower Car Insurance Premiums In California

https://www.youtube.com/embed/cPP869jADcEThe most inexpensive cars and trucks to guarantee are usually basic model automobiles that are least likely to be stolen and have top safety features.:.

AboutWhat Does How To Reduce Your Car Insurance Rate Do?

Property Damage Liability: This pays when you hit another person's vehicle, or other residential or commercial property and typically remains basically the samebut, you'll discover higher premium for bigger cars (much heavier) or lorries that are older and have few safety functions like anti-lock brakes. Larger can trigger more damage for this reason the higher premium for much heavier automobiles.

You will see the bigger or the more security features your automobile has, the premium will be less compared to other cars without those security features. More secure lorry implies you are less likely to be injured and for that reason the lower premium.

These are not the necessarily the answers that folks want to hear, however that is the reality of automobile insurance in NH, or throughout the nation. What we provide at Fortified Insurance Company is the ability to have us check prices with other providers. This allows us to see if your insurance coverage program is "market appropriate"and if we discover something priced better with commensurate protection, we'll immediately move your policy.

The Single Strategy To Use For 15 Tips And Ideas For Cutting Car Insurance Costs - Investopedia

Automobile insurance does go down at 25. The average cost of automobile insurance for a 25-year-old is $3,207 for a yearly policy. By contrast, motorists pay an average of $7,179 at 18 and $4,453 at 21 which demonstrates that cars and truck insurance coverage does decrease as you age. This milestone isn't as wonderful as you may believe.

Read on to find out more details about when car insurance coverage does go down. When does vehicle insurance get more affordable for young motorists?

What age does car insurance go down for male vs female motorists? Your car insurance coverage does decrease after you turn 25, but not as much as it does on other birthdays. Unless you live in a state where insurance providers can't factor gender into insurance rates, one substantial modification take place at age 25: the distinction in between what male and female motorists pay for vehicle insurance coverage.

Auto Insurance Rates Decreasing In 2021 For The First Time In ... Things To Know Before You Get This

Does vehicle insurance coverage from significant national insurance providers go down at 25? We evaluated quotes from four of the largest auto insurer Geico, State Farm, USAA and Progressive and discovered that while car insurance does decrease at 25 with each of them, the quantity it reduces by differs significantly.

Unless you live in among the couple of states that have made it illegal, a lower credit rating might increase your cars and truck insurance premiums. If you transfer to a neighborhood with higher rates of theft and vandalism, then insurance companies will charge you greater premiums to account for the increased danger of damage or theft.

Every insurance provider computes rates in a different way, and some insurer will stress different elements more greatly than others. We advise reassessing your insurer every year to get the finest rate. How to get more affordable car insurance as a 25-year-old chauffeur If you're a young driver in your 20s, you've most likely wondered how to reduce your automobile insurance costs.

What Does Does Car Insurance Go Down At Age 25? - Valuepenguin Mean?

Strategies for how to make your car insurance decrease By the time you hit age 25, you've most likely passed the point where you can remain on your moms and dads' insurance coverage. (If you have not, nevertheless, you need to definitely do so, since this is one of the best ways for young chauffeurs to save money on their premiums.) Thankfully, there are other methods for 25-year-olds to get their insurance rates to go down.

As your automobile's worth depreciates gradually, however, consider lowering or getting rid of crash and comprehensive coverage. If your automobile is just worth a couple of thousand dollars, it doesn't make good sense to pay out for high premiums to cover a possession of restricted worth. If you're married and each of you drives separate vehicles, you may have the ability to lower your automobile insurance coverage payment by, as insurance providers consider married couples more financially steady and risk-averse.

Discounts for 25-year-old drivers As you shop around for the very best rate, make sure you're also asking insurance companies about all applicable discount rates. Twenty-five-year-old chauffeurs might not be able to benefit from student-away-from-home or good-student policies, however there are plenty of other ways these young chauffeurs can save on cars and truck insurance: You may not be able to get approved for a good-student discount rate any longer, however your university might have partnered with an insurance provider to secure discount rates for alumni.

9 Easy Facts About 9 Major Factors That Affect The Cost Of Car Insurance Described

By taking a, you'll not only discover how to drive more securely, but you can decrease your automobile insurance premium anywhere from 5% to 20%. Be advised, nevertheless, that some states and some insurance providers only extend this discount to seniors or drivers under 25. Consult your insurer to see if you qualify before you sign up for a class.

Does your cars and truck have particular security functions, such as anti-lock brakes or daytime running lights? You could get a vehicle discount due to the fact that of it. Ask about these discount rates when you call insurer for a quote. You might be surprised at the savings you're able to produce simply by asking concerns.

: Your age, Your driving experience and claims record, Your credit rating, Your address, occupation, or usage of the car, Your choice of insurance coverage business Here are commonly asked questions with examples of how each of these factors impacts your insurance price, and when you can expect to get car insurance discounts or get a lower rate on cars and truck insurance coverage as a result.

How When Does Car Insurance Go Down can Save You Time, Stress, and Money.

For each year you do not have a claim, you come closer to benefiting from a claims-free discount, great motorist discount rate, or chosen rates. To assist your insurance rate go down when you've had a claim, consider: Leveraging your insurance by integrating your house and automobile insurance to get another discount rate, Taking a greater deductible to save money (because making small claims is probably the last thing you will desire to do if you are attempting to tidy up your claims record)Think about getting a usage-based insurance coverage discount What About Starting a Profession or Getting Married? Age is a major consider the rate of cars and truck insurance coverage since many other things go hand-in-hand with age.

You may move into a more secure community, which can save you cash on insurance coverage. Some insurance coverage business will reduce the expense of your insurance or offer a discount if you are wed or have a household.

https://www.youtube.com/embed/2Mc3pflbMdM

You don't have to remain with the same insurance coverage company to wait for your automobile insurance to go down. Does Cars And Truck Insurance Go Down With a Good Credit Score?

AboutThe Buzz on Buying Car Insurance For The First Time - The Aa

Your very first cars and truck may not always be the automobile of your dreams, however it's one you'll constantly keep in mind. Taking your time to make sure you're getting the automobile that's right for you as well as protecting your investment with vehicle insurance coverage is crucial to making certain that you'll more than happy with your choice in the future.

Being unskilled behind the wheel of a cars and truck generally causes greater insurance rates, however some companies still provide fantastic costs. Much like for any other chauffeur, discovering the very best cars and Hop over to this website truck insurance coverage for brand-new drivers indicates doing research study and comparing prices from multiple providers. This guide will give an overview of what brand-new motorists can anticipate when paying for car insurance coverage, who qualifies as a brand-new chauffeur and what elements shape the rate of an insurance policy.

As pointed out, age is one of the main points insurance provider look at when putting rates together. Part of the reason insurer hike rates for more youthful chauffeurs is the increased possibility of an accident. Automobile crashes are the second-highest leading cause of death for teens in the U.S., according to the Centers for Disease Control and Avoidance.

Adding a young chauffeur to an insurance coverage will still increase your premiums significantly, but the amount will depend upon your insurance provider, the lorry and where you live. Teenagers aren't the only ones driving for the very first time. An individual at any age who has resided in a large city and mostly depended on public transportation or who hasn't had the methods to acquire a car could also be considered a new driver.

Getting The Compare Insurance For First Car - Moneysupermarket To Work

Even though you might not have experience on the roadway, if you're over 25, you might see lower rates than new teenager chauffeurs. Another thing to consider is that if you live in a location that has public transit or you do not intend on driving much, there are options to conventional insurance, like usage-based insurance coverage.

Immigrants and foreign nationals can be classified as brand-new chauffeurs when they initially enter the U.S. This is because vehicle insurance provider usually check domestic driving records, so you can have a clean driving record in another nation and still be thought about an inexperienced driver after transferring to the States.

We advise utilizing the following techniques if you're purchasing automobile insurance for new motorists. Compare companies No two insurance coverage business will offer you the exact same price on protection.

Our suggestions for vehicle insurance for new drivers Whether you're a new chauffeur or have been driving for decades, looking into and comparing quotes from several companies is an excellent way to find the finest rate. Our insurance coverage professionals have found that Geico, State Farm and Liberty Mutual are outstanding choices for automobile insurance for new drivers.

The Of Auto Insurance: Common Myths

With programs like Steer Clear for chauffeurs under the age of 25, we acknowledged State Farm as an excellent alternative for trainees. Plus, its network of local agents can be available in convenient if you're unsure just how much coverage to purchase as a new motorist. Frequently asked concerns Our picks for the finest car insurance for brand-new motorists are Geico, State Farm and Liberty Mutual.

The end result was a general score for each company, with the insurance companies that scored the most points topping the list. In this article, we selected business with high general scores and cost scores, in addition to those with programs targeting new drivers. The cost scores were notified by car insurance coverage rate price quotes created by Quadrant Details Solutions and discount rate chances.

Guide to Buying Automobile Insurance, To pick the ideal insurance, you'll require to do some research study. Here's how to purchase cars and truck insurance:1.

Twenty states require uninsured motorist coverage, and seventeen states require underinsured vehicle driver coverage. Choose Cars And Truck Insurance Coverage Business to Research Study, Get a recommendation from a family member or buddy or do an online search for car insurance coverage companies.

The 9-Minute Rule for How To Get Car Insurance For The First Time - Car And Driver

You'll be able to see info such as the number of grievances about a company compared with the nationwide mean and a complaint tracking report, which reveals whether complaints are ending up being more or less frequent. 3. Get Rate Quotes, Get several quotes for the exact same amount of protection so you can choose which plan best fits your budget plan and requirements.

Getting cars and truck insurance coverage can be as time-consuming as a phone call to an agent or as quick as tapping a couple of links on your phone. Whichever approach you pick, you can boil down the procedure of shopping for car insurance to these 5 actions: Determine your coverage needs. Pick how to shop for car insurance coverage.

Select how to purchase automobile insurance, Here are the primary paths you can take when getting car insurance and what to know about every one. Auto insurance coverage direct from the insurance company, With direct auto insurance, there's no requirement to seek out an agent or broker. Online cars and truck insurance prices estimate from insurers' websites and third-party comparison sites are popular, but you can also get direct insurance estimates over the phone.

Possible drawbacks: While all direct insurance providers have agents to field concerns, you may not get reactions as detailed as you would from an agent. Online automobile insurance quotes aren't guaranteed; rather, they're price quotes that may differ from your final cost. You'll require to share personal information to get an accurate quote and might get follow-up calls and emails.

Getting Insurance For First-time Drivers Over 25 for Dummies

You want somebody to assist you manage multiple policies. You want familiarity and a long-lasting relationship with your insurance provider. Possible downsides: Captive agents are limited in the rates and policy features they can use, which might be off-putting for shoppers searching for more options. Agents are paid a portion of your premium as commission, which might incentivize some to offer more expensive policies.

https://www.youtube.com/embed/2YPLzOgWUV8

Good choice for you if: You want someone who can describe the complex parts of your policy. Independent representatives and brokers deal with lots of insurance business and may have a greater sense of how particular policies and agreement details vary from one company or state to the next. You like the idea of dealing with a representative however desire more cost and protection versatility than captive reps can offer.

AboutRumored Buzz on Best Cheap Car Insurance For Teens And Young Drivers In 2021

Nevertheless, teenagers can take several steps to reduce their vehicle insurance rates: The insurer may offer your teenager a discount for taking the course. Many classes can be completed online. The majority of insurance provider reward chauffeurs under the age of 25 if they bring a B average in high school or a GPA of a minimum of 3.

0 in college. Teenagers who drive a sports vehicle willpay more in insurance coverage than those who have a late-model sedan. Older, more run-down cars don't require comprehensive or accident coverage, as you'll likely invest more on insurance coverage for the year than the vehicle deserves. It makes sense that the longer you go without suing or having a mishap, the less expensive the insurance coverage ends up being. Have your teen continue driving safely, and prevent sending small claims. When shopping for the most inexpensive automobile to guarantee for your teenager, keep in mind that there are other ways to save cash on vehicle insurance. By doing a little research, connecting directly to your insurance provider, and having your teen practicing safe driving practices, your teen's insurance rates can drop significantly. You might be able to find more details about this and similar content at piano. io. is vital for any motorist(it's even obligatory in 48 states), however it's especially important for new drivers, whose lack of experience makes them.

most likely to have mishaps. Discovering the ideal policy, however, can be an obstacle. What sort of protection do you require? How do you stabilize cost and protection? Do you actually need collision coverage? It's a lot-- but we're here to assist. Nationwide 5 things to do prior to choosing a vehicle insurer for a teen, Decide if you're getting a different auto insurance policy for your teen or if you desire your teen noted on your insurance coverage. The former is normally considered cheaper in the short-term as your own car insurance premium will not go up. Choose which cars and truck insurance protection benefits are essential to you, and ensure to look out for them when speaking to an insurance agent. For circumstances, numerous insurers will not extend accident forgiveness to younger chauffeurs, but Nationwide will. Inspect which car insurance discount rates your teenager might be qualified to.

Not known Details About Teen Driver? 10 Ways To Get Discounts On Car Insurance

.jpg)

https://www.youtube.com/embed/Ylple33_6ts

get. The business is already No. 1 when it pertains to consumer service and satisfaction, and you can trust its reputation when including a young adult to your insurance coverage. Leave it to Geico to use economical car insurance coverage that makes things uncomplicated and simple, no matter the job. Geico's private policy rates vary on a state-by-state basis, however it's regularly ranked among the least expensive alternatives in any state. It also provides the exact same discount rates as numerous of its competitors, including advantages for great trainees and for chauffeurs who have taken driving training courses. Also remarkable is that teens that shift from a family policy to their own car insurance might get approved for a 10 %Tradition discount on their insurance. Nationwide Cars and truck insurance is more expensive for teenagers since of the understanding that their inexperience makes them most likely to be associated with mishaps. Whether this is real or not, the fact stays that a person in 5 16-year-old motorists gets a mishap on their driving record in their first year behind the wheel. Nobody wants to invest a lot on a cars and truck insurance coverage, particularly when the vehicle in question may only be utilized on rare events. Just the thought of spending thousands a month in insurance expenses on a vehicle that's often in a parking area is stress-inducing. Not only does Progressive offer everyday low rates, but it's likewise created a series of discount rates that use particularly to university student. Teenagers can likewise make the most of Progressive's Photo program, which rewards chauffeurs for driving safely with discount rates and other cost savings. Progressive's website also uses a list of suggestions to help moms and dads identify if they ought to add teenagers on their plans or get them their own. Erie Insurance Coverage Pennsylvania-based Erie Insurance has actually been guaranteeing drivers for almost 95 years, and its credibility for sterling service encompasses young motorists also. "If there is a young driver on your policy who is ... away at college without an automobile,"states Ruiz, "you might likewise get approved for a lower rate. "Every insurance carrier offers different discounts depending upon your coverage option and other factors, so it pays to check which ones use to you before registering . It's also a fact that teen young boys are more costly to contribute to a policy than teen ladies, as they're most likely to be involved in a major vehicle accident. Progressive deals a range of discount rates for university student to save money on automobile insurance. Progressive How do you choose the best coverage? The very best protection for you is the one that fits your requirements, addresses your concerns, and makes sense for your situation. Even teens with clean accident records will face high automobile insurance rates for a number of years due to their absence of driving experience. At age 25, rates generally start to decline, and middle-aged motorists take pleasure in the finest rates. It isn't until about age 65 that rates begin to sneak back up again(see chart below). Typical rates are shown for a policy with protection of$100,000 bodily injury per person per mishap, $ 300,000 bodily injury for accident,$100,000 residential or commercial property damage per accident. Crash and thorough coverage was not consisted of . Reducing Vehicle Insurance Coverage Premiums for Teenage Motorists There are ways to reduce auto insurance coverage rates for a teen driver, however buying a vehicle for the teenager and putting him on his own policy isn't among them.(This average includes all liability protection levels.)Compare that to an average cost increase of $621 for including a teenager to the moms and dads 'policy that means you'll pay 365 percent more by putting the teenager on his/her own policy. Instead, compare car insurance coverage estimates from numerous companies. If your teen has a good grade point average in school, ask if your car insurance business provides a good student discount rate. States slowly brought back greater minimum getting ages so that, by the end of 1984, 22 states had minimum buying ages of 21 in effect. Federal legislation was enacted to keep highway funds from the staying 28 states if they did not follow suit. Given that July 1988, the minimum alcohol purchase age has actually been 21 in all 50 states and the District of Columbia.

AboutWhat Is Total Loss And What Does It Mean For Your Car ... for Dummies

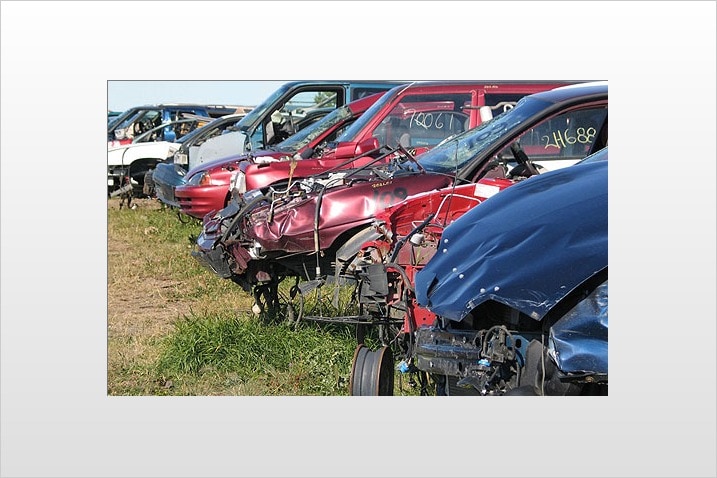

Martin Diebel, Getty Images If you've just recently been associated with a mishap where your vehicle was severely damaged, you may be wondering how much insurance pays for a totaled car. They will state your vehicle totaled if it's not worth the cost to fix it. Each insurance supplier has a formula for determining whether to total your cars and truck.

There are 3 primary factors that insurance business use to choose when to amount to a car. If it will cost more to fix your vehicle than it's worth, they will total it.

Arm yourself with information so you can be well-prepared for handling your insurance coverage service provider when and if your car is totaled. How Much Is Your Totaled Vehicle Worth? To get a concept of what your amounted to automobile is worth, find the Kelley Directory value for it in reasonable condition.

An adjuster will be sent by your insurance supplier when you report a mishap to them. They will examine the damages done to your automobile to identify whether it will be considered an overall loss. If they do choose it's amounted to, they will appraise its worth based on its condition immediately prior to the mishap occurred.

My Car Is Totaled - Will Insurance Pay? - Thompson Law Firm Can Be Fun For Anyone

The insurance coverage company will think about the real cash worth provided by both adjusters to choose what your lorry is worth. The insurance business will search current sales in your location of lorries comparable to yours and compare them to existing listings to discover your automobile's ACV.

You also need to bear in mind that your deductible will be subtracted from the amount the insurance provider pays for your amounted to lorry. Generally, you can anticipate payout for your totaled car within a couple of days after the ACV has been determined. There are 2 instances where you might not get cash for your amounted to car: If you rent, If you have a loan, The insurance coverage business will pay the quantity you owe to your loan service provider.

If you leased your cars and truck, the exact same thing uses. You can consult your adjuster to learn when you can anticipate payment. They need to likewise know the length of time the insurance provider will spend for the rental automobile, if one was offered. Understanding Your Protection, In order for your vehicle to be covered by insurance coverage when it's amounted to in an accident, you require to have the best insurance coverage.

Space is an acronym for Guaranteed Car Defense, and it's great to have if you owe more for your car than it's worth. You won't ever see the cash from having this type of coverage, as it all goes directly to the lending institution in the event your vehicle is amounted to.

The 2-Minute Rule for My Car Was Totaled In A Car Accident. Will I Get Paid Kelley ...

While some suppliers will change your vehicle if it's less than 3 years old, having this type of protection means you do not have to fret about the payment amount for a totaled automobile. Your new car will be covered.

You keep it and repair the damages. Usually, a totaled car will be auctioned off to a salvage backyard and the insurance provider will keep the money from this sale. If you are permitted by law to keep your amounted to automobile, the insurer will get quotes from different salvage companies and set the fair market price from these quotes.

The title will need to be altered to a salvage title, as this is a requirement in most states. This indicates you can't get license plates till you make the necessary repairs and make an application for a new title. You should consult your insurance supplier about the laws on a salvage title in your state prior to you decide to keep your amounted to automobile.

Sources: This material is developed and maintained by a third party, and imported onto this page to help users supply their email addresses. You might be able to find more info about this and comparable content at piano.

Not known Details About How Much Insurance Pays For A Totaled Car: Quick Guide

If you have $16,000 worth of damage, that's 80% of the reasonable market value. In states with a total-loss threshold listed below 80%, it would be considered totaled. If you could offer your lorry minutes before your accident, how much cash could you get for it? Important Real cash worth is another method of stating what the lorry is worth at the time of loss.

Some things that insurance coverage companies utilize to determine the real worth and the overall loss value of your automobile are its year, make, design, mileage, physical wear and tear, and damage caused in the mishap. If your car is relatively brand-new and in great condition, it will clearly have a higher real worth than a cars and truck that is old and worn out.

If you still owe cash on your vehicle, this benefit, all or in part, goes straight to your loan provider instead of to you. Why Your Total-Loss Reward Is Less Than Your Loan Lots of people have actually faced the aggravating situation of getting a reward check, only to recognize it's not enough to cover their auto loan's staying balance.

Here are some factors your car's benefit might be less than your loan balance. Automobiles Depreciate in Value The 2nd you drive your new car off the lot, its value starts to depreciate, and it continues to do so over its lifespan. In fact, cars depreciate approximately 20% during their very first year and an additional 40% in the next 4 years.

Not known Details About Totaled Car Guide - Coverage.com

If you don't have space insurance coverage, you are accountable for the distinction between your insurance coverage payment and your vehicle loan balance. You Rolled Over a Previous Cars And Truck Loan Into Your Existing One If you rolled over a previous auto loan, that unfavorable equity is contributed to your loan. This indicates your loan is for more than the present car's worth, and your total-loss benefit likely won't cover the balance.

You need to show that your automobile is worth more than the insurance provider states it is. Keep Auto Loans Different If possible, do not roll the remaining balance of your loan into a brand-new loan for your next vehicle. If you do, you'll owe more on the new vehicle than it deserves.

Frequently Asked Questions (Frequently asked questions) What takes place to your vehicle when it's considered amounted to? If your vehicle is amounted to, you need to transfer the title to your insurance company prior to it will send your payout.

https://www.youtube.com/embed/mZwgIPmeglw

Contact your representative for the exact steps in this procedure.

AboutThe 7-Second Trick For 7 Best Cars For Teenagers In 2021 - Carfax

Methodology In an effort to provide precise and unbiased info to customers, our expert review group collects information from dozens of car insurance coverage service providers to formulate rankings of the very best insurance companies. Companies get a rating in each of the following classifications, in addition to a total weighted score out of 5.

Teenagers have less experience on the roadways and are more most likely to get in accidents, so automobile insurance for teens tends to be pricey. Scoring a great rate is still manageable.

How much is car insurance for teens? When it concerns vehicle insurance coverage for teens, young drivers pay more than their older, more experienced counterparts-- about $169 per month usually, according to our analysis. It comes down to simple statistics. Teenagers 16 to 19 are almost twice as likely to experience fatal cars and truck mishaps, according to the Insurance Institute for Highway Security (IIHS).

Plus, insurer do not have as much information to take a look at when examining how responsible a teen driver is on the road. That signals more threat to insurance providers, which is why vehicle insurance for teens is more expensive. Teen male vs. female cars and truck insurance rates, In our analysis, we found that male teen drivers pay about $20 more per month than female teen chauffeurs.

4 Simple Techniques For 5 Tips For Buying Car Insurance For Teenagers - Money ...

Teen males are most likely to get in wrecks. They have actually caused two-thirds of all accidents amongst teenagers 16 to 19 recently, according to IIHS data. How to discover low-cost insurance coverage for teens, The very best method to discover inexpensive automobile insurance coverage for teenagers is to compare rates from a number of business.

While they all think about teen drivers riskier to guarantee than older chauffeurs, they don't all upcharge teens the very same quantity. So the only method to see which offers a young motorist the very best rate is to compare quotes side by side. In addition to searching, look for teen-specific vehicle insurance discounts, like the ones discussed below.

Another way to make cars and truck insurance coverage for teens more affordable is to minimize their protection levels. But this is dangerous and may not even be possible. For example, a lender may not permit clients to eliminate crash and detailed protection if they have a lease or loan on their car.

This offers a teen driver the advantage of any discounts their moms and dads receive, like a multi-policy discount for bundling house and automobile and a discount for constant insurance protection, that teenagers may not get approved for by themselves. Naturally, including a teenager motorist implies greater rates for parents, so that's something each family needs to think about.

The Main Principles Of Car Insurance For Teens Guide

There's no law about when a young driver has to get their own insurance coverage, however for the most part, if they're living independently, spending for their own expenses, and driving their own vehicle, they should probably have their own policy. Best automobile insurance coverage for teens, Here are a few of the finest vehicle insurance coverage service providers for teenager drivers:.

1.

The best behaviors really result from an early education, not only understanding how the credit game works. Research study reveals that children start establishing their behaviors around cash as early as age 3 and they are almost solidified by age 7.

In Gardner's book, one of the characters, properly named Spender Bear, faces problem when he purchases only what he desires. He must work with the other bears to develop a spending plan that consists of saving, investing and donating money too."Spender Bear is high on life until he spends beyond your means and loses whatever," Gardner explains.

Our Teen Driver Technology - Chevrolet Statements

2. Teach the distinction in between a debit card and a charge card, When your kid is young, they will observe you swiping your card at the checkout, and they will easily make the connection that a card is a lot like cash. While a debit card is money in essence, a credit card is obtained money.

Incentivize conserving, Rewarding your kids for chores is more reliable when you incentivize saving, according to Sheehan, who established the Greenlight app to assist parents teach their children how to responsibly use a debit card (which equates to responsible charge card use later, states Sheehan)."With the Greenlight app, you can set up weekly chores and connect that to a weekly or regular monthly allowance," describes Sheehan.

Jointly, the approximately 1 million parents and kids who use Greenlight have put about $25 million in savings, or approximately $25 per kid usually. The parents who utilize the app's parent-paid interest feature see their kids saving more, and the kids are presently earning an average of 18% APY from their moms and dads' "bank," Sheehan states.

4. Assist them save early for a protected credit card, If your teen is interested in opening their first charge card at 18, you might wish to encourage them to save up the deposit required to open a protected charge card. In many cases, if you have a savings account at a bank or credit union, you can borrow versus that account to open a guaranteed card.

The Best Strategy To Use For Car Insurance For Teens Guide

.jpg)

If they do it right, they can continue to grow their cost savings while likewise building great credit. If you're not interested in joining a credit union, you could suggest your child use for the Capital One Guaranteed Mastercard. It stands out because Capital One will review cardholders' accounts regularly to give qualified debtors access to more credit and to ultimately upgrade them to a unsecured card.

6. Have them report all possible kinds of credit, It can be difficult for a young adult to develop credit, considering that 15% of a person's credit rating pertains to the length of time they've been a customer and their overall monetary history. There is a rather new service to this.

https://www.youtube.com/embed/5zailym2dd0

, they can give the bureaus access to their "telecom and energy bills," states Griffin. Once an individual concurs to the service, all of their payment history, reaching as far back as 2 years from the time of signup, will be included to their credit report.

AboutAbout My Car Was “Totaled.” Now What? - Levin & Malkin, Pc

Let's say your cars and truck is worth $20,000. If the cost to fix the damages is $15,000 or higher, your car is totaled.

Each state has various laws and requirements. In Texas, the total-loss limit is 100%. That indicates the repair cost should fulfill or surpass the cars and truck's ACV to be amounted to. Total-loss formula In states without any total-loss threshold, like Arizona, insurance business use their own equations or formulas to figure out if an automobile is amounted to.

The Basic Principles Of How Do Insurance Companies Determine Car Value?

Who is at fault? If an accident harmed your automobile, did you cause the crash or is another motorist at fault? The response to this question identifies if your insurance provider or another person's insurance provider handles the payment. Negotiating with another person's insurance coverage supplier can be hard. Regardless, the insurer will examine the damage and make a settlement or payment offer.

Don't accept any payment without first examining the insurance company's math to make sure you're getting a reasonable offer. Are you covered? If you're at fault for the accident, ideally you have more than state-minimum insurance coverage. State-minimum vehicle insurance coverage doesn't include collision protection. Crash coverage pays for damage to your car.

The Of How Do Insurance Companies Determine Car Value?

If your vehicle is amounted to, your insurer will cut you a look for $15,000. You owe the lender $2,500, and you no longer have a cars and truck. This is why space insurance coverage exists and can be an excellent purchase for people with brand-new or expensive automobiles. Gap insurance covers the distinction between what you owe on a car and what it's worth.

What does insurance pay when a cars and truck is amounted to? How and just how much your insurance pays for an amounted to cars and truck depends upon a couple of aspects, consisting of the company and the state you call house. These are the compensation alternatives for an amounted to cars and truck in Washington State: Replace your automobile with an offered and similar car.

My Car Is Totaled - Will Insurance Pay? - Thompson Law Firm Can Be Fun For Everyone

If you can, get at least one price quote from a reputable body store in your area. Compare it to the insurance business's report. Hire an appraiser If you think your insurance coverage company is way off the mark with their payment, think of employing an appraiser. This must be a last-ditch effort, however, as appraisers aren't complimentary.

All material and services offered on or through this website are provided "as is" and "as readily available" for use. Quote, Wizard. com LLC makes no representations or service warranties of any kind, express or suggested, regarding the operation of this website or to the info, content, materials, or products included on this website.

Some Known Details About Will A Collision Repair Shop Fix Your Totaled Car?

That depends upon whether the automobile is owned, funded, or leased., we'll pay you directly to a finance business that's listed on your policy or your title: We'll pay the financing company first If the settlement amount is more than what you owe the finance business, you'll get the rest (if you're the entitled owner) If the settlement amount is less than what you owe, you'll be accountable for paying the balance of your loan *, we'll pay the lease company directly * If you have, it might cover the balance of your loan.

The cash we make assists us offer you access to complimentary credit ratings and reports and assists us create our other great tools and academic products. Payment might factor into how and where items appear on our platform (and in what order). Since we typically make cash when you find a deal you like and get, we attempt to reveal you offers we believe are a good match for you.

The Only Guide to What Should I Do If My Vehicle Is Totaled? - Kelley Blue Book

If your vehicle is amounted to, one of your very first concerns is most likely how you'll get a brand-new one and whether insurance will cover the loss. While the response varies from one circumstance to another, something is clear: A strong auto insurance coverage can help get you back on the roadway while securing your finances.

Paying too much for cars and truck insurance coverage? Your car can be damaged and even totaled in numerous different ways. There are crashes, which occur when your cars and truck strikes another lorry or things, like a deer and even a tree. Crashes can include one car or lots of. Cars and trucks can also be damaged in non-collision circumstances.

All About Totaled Car? Here's 5 Questions To Ask Your Auto Insurance

No matter how your car is harmed, you'll need to sue with your automobile insurer if you're intending to get the loss https://www.atoallinks.com/2021/excitement-about-my-car-was-totaled-now-what-levin-malkin-pc/ covered. Your insurance provider will send out an adjuster who will examine your lorry's damage and approximate the cost to fix it. A vehicle is thought about totaled if the cost to repair it is approximated to be more than its existing worth.

Some states, such as Alabama and Kansas, may just require that the damage equates to 75% of the vehicle's value in order to be declared an overall loss. If you live in one of these states and your vehicle is worth $10,000 and repair work are estimated to cost $7,500, your insurance company would state it a total loss.

The Basic Principles Of What Happens If You Total A Leased Car? (Answered)

If it pertains to preparation for the future, leaving financial obligation, or eve Learn more. Find out more.

Learn what enters into the decision and what your alternatives are. If your cars and truck has actually been harmed and the possible repair costs go beyond the value of the vehicle, it is thought about a total loss. Here are responses to common concerns that spring up when your lorry has actually been stated totaled.

How Do Insurance Companies Determine Car Value? Can Be Fun For Anyone

Frequently, the repairs are approximated to cost more than what the vehicle deserves lorry worth being the actual money worth figured out by its year, make, model and significant choices, along with mileage and total condition. (Though the damage might not look bad, the repair work can cost a lot more than you 'd believe.) Other reasons for amounting to a vehicle include when the damage makes the vehicle irreparably unsafe or if your state's regulations need it for your automobile's damage severity.

What if I'm still settling the car? You'll be accountable for pleasing your loan arrangement whether the cash you receive covers it all. This is why you might think about SPACE (Guaranteed Property Security) insurance coverage, so called due to the fact that it covers the gap between what you owe on the automobile and its present market worth.

The Ultimate Guide To Lessons From A Total Loss: Dealing With Car Insurance After ...

It depends on your insurer to decide whether to pay for repairing your automobile or to declare it an overall loss and pay you its book worth. You might be able to make a case that the pieces of the vehicle were worth more than the book value and so increase your settlement.

, so do not be shocked. Just as you desire to be sure your vehicle is adequately fixed, they wish to ensure they don't pay a grossly inflated repair bill. Note that one aspect that might lower the quantity of your claim for a repair work job is what insurance coverage business call betterment.

After An Accident - Nc Doi Fundamentals Explained

What Is Total Loss Automobile Insurance Coverage? Overall loss cars and truck insurance coverage means you have the best protections to help you pay for a new vehicle if yours gets amounted to.

Some utilize an overall loss threshold, which can differ in between 50% and 100%. For instance, in Arkansas, the overall loss limit is 70%. This implies your automobile is declared a total loss if the damages are greater than 70% of its worth. So, if your automobile is worth $6,000 and sustains more than $4,200 in damages, your insurance provider will consider it an overall loss.

The Basic Principles Of How Much Will My Car Insurance Go Up After An Accident?

https://www.youtube.com/embed/NnR3bstSBSoIf you've been in a mishap and your cars and truck takes a serious pounding, it will probably be thought about amounted to by your insurance coverage business. What does it really indicate if your cars and truck is totaled, and what do you do about it?

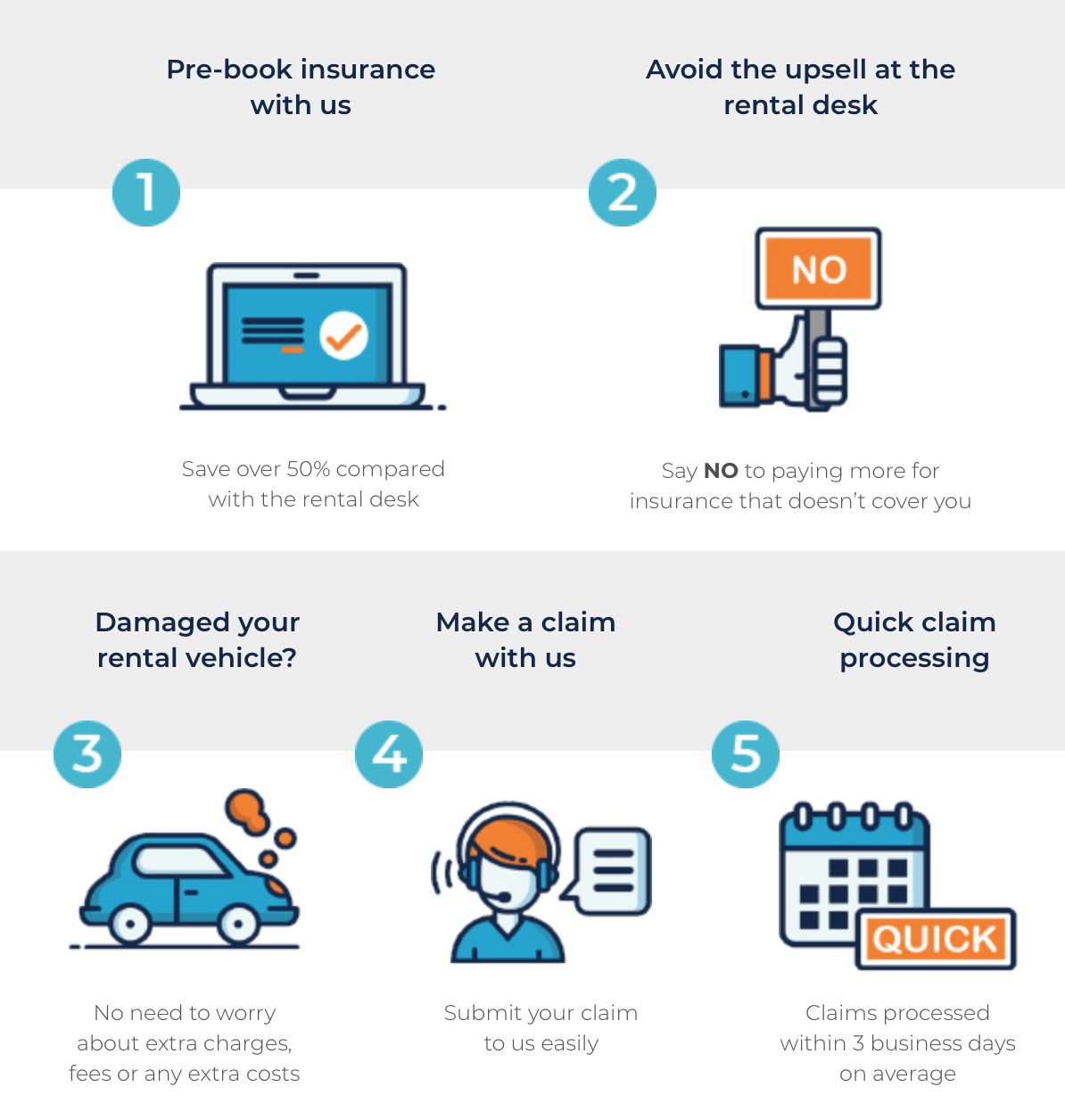

AboutNot known Facts About Things To Know About Car Insurance And Rental Cars Before ...

We will accept out-of-state lorry insurance coverage of any type. If your car is registered in New York, it must have New York State auto liability insurance protection.

Wondering how soon you have to get insurance coverage after purchasing a vehicle? Do not let not knowing enough about cars and truck insurance coverage be a downer on your day.

If this is your first car purchase and you don't have vehicle insurance coverage already, you have to buy insurance coverage before you can take ownership of the vehicle. Remember, it's prohibited in almost every state to drive a car uninsured and without proof of insurance, and the consequences of driving or being involved in an accident without correct insurance coverage can be extreme.

How Long Does A Car Insurance Claim Take To Settle? - Hi ... Things To Know Before You Get This

You require complete coverage to acquire the automobile. Some states need car insurer to provide a written letter with the intent to cancel your plan before doing so. In brief, it all boils down to your policy and your state laws. When reviewing state laws on cars and truck insurance plan, try to find grace duration and cancellation guidelines.

Some business might even likewise permit a particular number of late payments prior to implementing stricter guidelines such as if you're late on your payments three months in a row. Many business do not desire to lose you as a consumer over one late payment. Because automobile insurance coverage strategies are based on trust, be sure to do your due diligence to inform your company of any complications.

The exception to this is if you currently have an insurance coverage for a different vehicle. If you are adding a vehicle to your policy or changing one, your existing policy needs to cover the brand-new cars and truck too, so you don't require a brand-new policy before you drive the lorry house.

Examine This Report about Insurance - Motor Vehicle Division Nm - Mvd New Mexico

Here are a couple of more things you must learn about insurance when buying a car: When You Currently Have Insurance Coverage When You Do not Have Insurance You have a 7- to 30-day grace period (depending upon your state) to tell your automobile insurer about the new automobile. You must buy insurance coverage before occupying and driving the vehicle off the lot.

When you buy an automobile from a dealership, agents can also assist you find the ideal protection for your brand-new cars and truck on site. You'll be able to call an insurance provider from the car dealership to start a policy once you have actually selected the car you want. On the occasion that you currently have car insurance (perhaps for another cars and truck in your home), you can reveal your insurance coverage card at the car dealership.

In addition to the service providers you choose, aspects like your age, car make and model, and driving history can impact the car insurance coverage rates you see. If you remain in your 20s or have a DUI in your driving history, you're considered a high-risk chauffeur. Getting budget-friendly protection can be hard, so we recommend looking into Progressive automobile insurance coverage.

The Best Guide To Things To Know About Car Insurance And Rental Cars Before ...

https://www.youtube.com/embed/WjZMF750OQU

Learn more in our full Progressive insurance coverage evaluation. State Farm auto insurance coverage is our top option for trainees, however the majority of motorists can discover terrific coverage with State Farm. The insurance provider has a variety of discount rates and mobile apps like Steer Clear and Drive Safe & Save. Avoid is a driving refresher program that motivates safe driving habits in customers under the age of 25, while Drive Safe & Save monitors driving practices for drivers of any ages to assist them conserve on car insurance.

AboutNot known Facts About What Happens When There's Not Enough Car Insurance To Pay ...

As far as insurers are worried, a vehicle insurance lapse formally suggests there was no vehicle insurance protection for 30 to 60 days. It likewise puts you in the high-risk motorist swimming pool, even if there are no other reasons for you to fall into that category.

If the lapse lasted up to 60 days, your rates might increase by as much as 48 percent. When the policy has actually lapsed for more than 60 days, it is likely your insurer will not restore it.

Charges are greater when insurance has lapsed more than once. A 2nd lapse in Florida costs about $250, and a third one sets the motorist back roughly $500.

About Do You Have Health Insurance? - Samhsa

Rather than cancel the policy, ask the insurance business to suspend your insurance for a specified period. Not all insurance coverage carriers will suspend a car insurance policy.

No matter the factor for a lapse, the driver is considered higher-risk by insurance provider. Even if you have a good driving record, a lapse will likely raise your rates. One way to avoid a lapse in protection if you aren't driving for a while is to ask a relative or good friend to add you as a driver on their policy.

/can-a-not-at-fault-claim-raise-my-insurance-rates-527469-final2-1396e7846dab4ca7b7548f81f829149b.png)

The vehicle insurance coverage lapse grace duration is not set in stone and varies by state. Much likewise depends upon the insurance provider. Some may offer a short grace duration. That is why it is very important to discover an insurance provider's grace duration policy when looking for coverage. Grace periods typically vary in between 10 and 20 days to enable you to foot the bill and avoid cancellation.

The Best Strategy To Use For Do You Really Need Gap Insurance? - Investopedia

As soon as the policy is reinstated, the insurance coverage normally remains continuous. If the policy lapses since the premium was unsettled, the insurance company will often renew the policy as soon as funds are received.

If you reside in a tort state, likewise referred to as a fault state, and were not at fault for the accident, you can call the at-fault motorist's insurance company and sue. If you reside in a no-fault state, where the driver's insurance is accountable for covering their own injuries and any damage to the automobile, you are not covered if your insurance has actually lapsed.

When a driver is guaranteed, their insurance business will defend them. Without any insurance, you need to combat by yourself or get a legal representative. If it is identified that you were at fault for the accident, and the other celebration was injured and the automobile damaged, you might be accountable for these bills.

Official Ncdmv: Vehicle Insurance Requirements - Ncdot Fundamentals Explained

Compare our quote to other insurers, and you need to see that The General offers the very best coverage meeting the requirements of those with lapsed insurance coverage. We can start your brand-new protection right away. If you require aid with an SR-22 filing, we can help you in getting the correct documents. For almost 60 years, we have assisted drivers discover economical insurance coverage meeting their needs.

Force-placed insurance tends to be drastically more pricey with lowered coverages and if you stop working to pay for the policy, your car will more than most likely be repossessed. You can change the force-placed insurance plan with another insurance coverage policy you discover however you will have to pay for the quantity of time you had the force-placed policy.

If you easy forgot to pay your costs and it's only been a few days, call your insurance provider and ask if they will restore your policy as they may want to assist. Anticipate your premium to be greater if the lapse goes past a week. If you have actually not had insurance coverage for months, know that insurers are more most likely to charge a greater rate and some may not be prepared to guarantee you at all.

The Basic Principles Of Getting A Driver License: Mandatory Insurance - Dol.wa.gov

A Brightway representative will have the ability to shop the marketplace and offer you alternatives from various insurance brands. Request any and all discount rates that you get approved for As soon as you've gone 6 to 12 months without occurrence, ask your insurance provider to recalculate your rates If you ever find yourself in a position where you are concerned about paying your Automobile insurance costs on time, think about the following details in order to avoid protection lapses: Look into the option of suspending your policy if you understand you will be chosen a certain amount of time.

Make certain to make any payments prior to the expiration date. * Details courtesy of Trusted Option.

Driving Without Insurance coverage Insurer alert the SCDMV if you're a vehicle owner and you cancel your insurance coverage. If you do not have present insurance coverage when the SCDMV gets this alert, you will receive a letter that requires you to have the insurance coverage company digitally validate insurance coverage within 20 business days.

A Biased View of What Happens When Your Car Is Totaled? - Usaa

You may need to pay up to $400 to reinstate your driving and registration benefits. While under suspension, you might not drive or sign up any automobile without insurance. If you do not return your plate to the SCDMV, a law enforcement officer will take it from you. What should I do to secure myself? All authorized lorries must be guaranteed.

You need to get your insurance provider to submit a Certificate of Insurance Coverage (SR-22) for three years beginning with the date of suspension.

1. What Motor Cars Are Covered by the Law? 2. What Occurs if You Are Stopped and Figured Out to be Running Your Vehicle Without Insurance? 3. How do Cops Officers and Penn, DOT Determine if You Are Running Your Vehicle Without Insurance coverage? 4. Do I Need To Program Proof of Insurance When I Register My Lorry? 5.

The Best Strategy To Use For Lapse In Coverage: Penalties By State - Carinsurance.com

If you can not reveal the officer a valid insurance I.D. card, the policeman will mention you for this offense and, if founded guilty, your vehicle registration and motorist's license will be suspended for three months each. In many cases, insurance coverage information noted on automobile registration renewal applications is confirmed with the indicated insurer.

All insurer are needed to inform Penn, DOT when an insurance policy is cancelled or ended by the insured or by the insurer. Penn, DOT sends by mail the automobile owner a letter requesting brand-new insurance info. If the owner fails to supply evidence of insurance, Penn, DOT suspends the owner's vehicle registration for three months.

The affidavit will exempt you from serving a three-month suspension only if you get insurance protection in less than 31 days from the date the lapse of insurance began. This may be a date determined by Penn, DOT or a date the insurance provider has indicated insurance protection was cancelled or terminated.

The smart Trick of Official Ncdmv: Vehicle Insurance Requirements - Ncdot That Nobody is Discussing

https://www.youtube.com/embed/g-LPFPrmcWoThe affidavit will exempt you from serving a three-month suspension just if you obtain insurance protection in less than 31 days from the date the lapse of insurance coverage started. This might be a date figured out by Penn, DOT or a date the insurer has indicated insurance coverage was cancelled or ended.

AboutWhat Happens If The At-fault Party Doesn't Have Car Insurance? Can Be Fun For Everyone

If you have a history of serious driving offenses, your insurance company might need to file an SR-22 or FR-44 kind on your behalf. These forms show that you have at least the minimum amount of insurance required by your state.

"If there's unpredictability in terms of how to price for the threat, most business are going to err on the side of caution and charge more," he stated.

If you're thinking about driving without insurance coverage, do not. Besides the substantial financial danger that you would take driving on the roadway, a DMV N.Y. insurance lapse features heavy charges. In this short article, we'll cover everything about insurance lapses in N.Y., consisting of the cost, what to do after a lapse in coverage, and methods to avoid lapses.

Not known Details About Driving Without Car Insurance - Nationwide

Fill out the kind below to begin comparing vehicle insurance coverage estimates in N.Y. or call our team at for an even simpler process.: DMV N.Y.

means that implies is no liability insurance coverage on protection operating vehicle, automobile can trigger a civil penalty by charge DMV. When the DMV finds an insurance lapse in N.Y., a citation for driving without insurance can lead to an arrest, an impounded automobile, and suspension of your license and registration.